BP Fair Fund

Frequently Asked Questions for Ordinary Shares

Background

1. What are the details of the SEC’s settlement with BP p.l.c?

The U.S. Securities and Exchange Commission (the “SEC” or “Commission”) brought an action alleging that BP p.l.c. (“BP”) violated federal securities laws when BP made materials misrepresentations and omitted material information known to BP regarding the rate at which oil was flowing into the Gulf of Mexico as a result of the explosion on the offshore oil rig Deepwater Horizon. BP paid $525 million in civil penalties to settle the action. The Court created a Fair Fund (the “BP Fair Fund” or “Fair Fund) by Order dated February 14, 2014 to distribute the civil money penalties paid by BP to harmed investors in accordance with the terms of the Distribution Plan approved by the Court on February 3, 2016.

2. I thought the BP Fair Fund was already distributed? Is this the same settlement?

The initial distribution of the BP Fair Fund was made to investors who suffered losses as a result of transactions in BP American Depository Shares (“ADS”), which were traded on the New York Stock Exchange.

The next distribution from the BP Fair Fund will be to investors that lost money as a result of transactions in BP ordinary shares, which were traded on the London Stock Exchange, the Frankfurt Borse, and other foreign exchanges. ADS holders are no longer eligible to participate in the recoveries from the BP Fair Fund.

Eligibility

3. Who is eligible to participate in the distribution of the Fair Fund?

You may be eligible for compensation from the BP Fair Fund if you purchased BP ordinary shares during the period from April 26, 2010 until 11:59 p.m. EDT on May 26, 2010 on the London Stock Exchange, the Frankfurt Borse, or another exchange outside the United States.

4. What securities must have I purchased to be eligible to participate in the recovery?

The following security is an eligible security under the terms of the Distribution Plan:

|

Security |

Symbol |

ISIN |

|

BP Ordinary Shares |

BP |

GB0007980591 |

5. Who is not eligible to participate in the distribution of the BP Fair Fund?

You are not eligible to participate in the distribution of the Fair Fund if you are or were:

- A person who served from January 1, 2010 through the end of the relevant period as an officer or director of BP, or any subsidiary or affiliate of BP directly involved in the conduct detailed in the Complaint;

- An employee or former employee of BP or any of its affiliates who has been terminated for cause, or has otherwise resigned, in connection with the conduct described in the Complaint

- A person who, as of the claims bar date, has been the subject of criminal charges related to the conduct detailed in the Complaint, unless and until such defendant is found not guilty in all such criminal actions prior to the claims bar date, and proof of the finding(s) is included in such defendant’s timely-filed claim form;

- A defendant in SEC v. Keith A. Seilhan, 2:14-cv-00893-CJB-SS (E.D. LA.);

- An affiliate, assign, creditor, heir, distributee, spouse, parent, child or controlled entity of any of the foregoing persons or entities described in i-iv above;

- The Distribution Agent and those persons assisting the Distribution Agent in its role as Distribution Agent; or

- A purchaser or assignee of another person’s right to obtain a recovery from the Fair Fund for value; provided, however, that this provision shall not be construed to exclude those persons who obtained such a right by gift, inheritance, devise or operation of law.

6. I was a BP employee and acquired ordinary shares through an employee benefit program. Do these shares qualify me for a payment?

The eligibility of the shares acquired through an employee benefit program will depend on which program you participated in. We will provide additional information regarding the eligibility of certain BP employee benefit plans in the coming weeks.

For certain plans, the trustee of the plan will file a claim on behalf of the particular plan’s participants with respect to BP ordinary shares purchased during the relevant period through the plan. In those cases, individual plan participants will not need to take any action in connection with the plan-level claim. Any settlement proceeds received by the particular plan will be allocated to participants by the trustee.

For other plans, it may be determined that either the program did not involve an eligible investment in BP ordinary shares, or that the individual plan participant should file their claim individually. As we gather more information, we will provide additional guidance regarding plan eligibility.

If you believe your participation in a BP employee benefit program did involve an eligible investment in BP ordinary shares during the relevant period, you may submit a claim and we can determine the eligibility of the transactions after the claim has been fully reviewed.

Any participants that held shares of BP ordinary shares directly (outside of an employee plan) must file a separate claim relating to those shares.

7. Do shares purchased by reinvesting dividends qualify for recovery?

Yes, shares purchased by reinvesting dividends are potentially eligible for recovery. Note that you must provide an account statement or other documentation for each purchase, including the date of purchase and the number of shares.

8. What is considered my official date of purchase (or sale) of my shares?

The “trade date” is the official date to use as the date of your transaction for purchases and/or sales. Many broker transaction statements provide both a “trade date” and a “settlement date”. The trade date is the correct date to use for purposes of completing a claim form.

9. I inherited (or received as a gift) BP ordinary shares. Am I eligible to file a claim?

The eligibility of a claim is dependent upon when the BP ordinary shares were originally purchased. The receipt of BP ordinary shares by gift or inheritance, for example, does not constitute a purchase for purposes of determining eligibility. If the original owner of the BP ordinary shares purchased the shares during the relevant period, you may be eligible to recover for those inherited or gifted shares.

You must include copies of broker statements or other documentation evidencing the original purchase of the BP ordinary shares with your claim. In addition, you must provide documentation of the transfer of the shares to you, such as the broker statements for the period in which the transfer occurred. In the case of an inheritance, you should attach copies (please do not send originals) of any legal documentation showing you are the legal recipient of these shares.

If the original owner purchased the BP ordinary shares outside of the relevant period, the shares would not be eligible for recovery.

The Claim Form

10. How do I apply to participate in the BP Fair Fund? How do I file a claim?

If you would like to apply to participate in the BP Fair Fund, you must submit a completed claim form that is postmarked on or before April 30, 2024. You may submit your claim form in one of the following ways:

| a. | You can file your claim using our online claims system here. You will enter all of your information directly into the online claim form, scan your supporting documentation, and upload the supporting documentation to your claim form. If you are unable to scan your supporting documentation, you can mail the supporting documentation directly to the Distribution Agent at the address provided herein. If mailing supporting documentation, you will be directed to print off a cover sheet from the website to include with your mailing. This will ensure your documentation is included with the appropriate claim. |

| b. |

If you prefer to complete and mail a paper claim form, you can download and print one here. Read and complete all required fields in the claim form, attach all necessary supporting documentation and mail the completed to: BP Fair Fund P.O. Box 6980 Syracuse, NY 13217-6980 |

You can ask the Distribution Agent to mail you a claim form by calling toll free (866) 344-7868, sending an email request to [email protected] or by writing to the address included above. Remember to provide your complete name and mailing address. Upon receipt, read and complete all required fields in the claim form, attach all necessary supporting documentation and mail the completed claim form to the Distribution Agent.

11. What is the deadline for submitting the claim form?

The claim form must be postmarked on or before April 30, 2024.

12. Do I need to submit supporting documents with my claim form?

Yes. You must provide with your completed claim form documentation of (a) the number of shares you held as of the opening of trading on April 26, 2010, if any; (b) all purchases and sales of BP ordinary shares between April 26, 2010 through 11:59 p.m. EDT on May 26, 2010; and (c) the number of shares you held as of May 26, 2010, if any. Please be sure the documentation confirms the details provided in your claim form.

All documentation must include adequate identifying information (i.e., your name and account number must appear on all documentation submitted). Handwritten modifications to the documentation or self-generated schedules or statements will not be accepted. Please do not send the originals of your supporting documentation; be sure to provide copies. Documentation should list the security, type of transaction, date of transaction, number of shares, and total amount of the transaction.

The types of documents that should be submitted to support your claim include:

- monthly brokerage or other investment account statements;

- trade confirmation slips; or

- a signed letter from your broker on firm letterhead verifying the information you have provided in the claim form.

If you do not submit documents with your claim form to verify your holdings and transactions in BP ordinary shares during the relevant period, we will be unable to validate your claim. Notices detailing any deficiencies in your claim will be mailed at a later date and you will have an opportunity to submit additional supporting documentation at that time.

13. What if I cannot provide all the supporting documents with my claim form?

It is very important that you provide documentation in support of the holdings and transactions listed on your claim form. Failure to do so may invalidate your claim. If you cannot locate these documents within your personal records, contact your broker or other account representative and request copies of the documents you need.

14. Will my information be kept confidential?

Yes. The Distribution Agent will use its best efforts to protect the privacy of the information you provide, and the Distribution Agent will not use the information in your claim form and supporting documents other than for the purpose of processing your claim. For more information, see our Privacy Policy located on this website.

15. Why does the claim form ask for my phone number and email address?

The Distribution Agent will likely need more information in order to process your claim form. The claim form asks for your phone number and email address so you can be contacted promptly if additional information is needed. The Distribution Agent will not voluntarily release this information to any person or entity not involved with the Fair Fund.

16. Why does the claim form ask for my Social Security Number (“SSN”), Tax Identification Number (“EIN”) or Passport ID Number?

The Distribution Agent needs this information to administer your claim during the claim administration process. These identifying items are necessary for a number of reasons, including enabling the Distribution Agent to ensure payments from the Fair Fund are not directed to prohibited participants listed on the U.S. Treasury’s Office of Foreign Asset Control’s (OFAC) records.

We recognize the importance of keeping your personal information secure, and we do everything under our control to ensure this data is protected. This personal information will only be used as necessary to administer your claim during the claim administration process.

17. I purchased shares of BP ordinary shares, but they were held in my broker’s name. Who should complete the claim form?

The beneficial owner of the shares of BP ordinary shares should complete the claim form. If you purchased the shares but they were registered in your broker’s name, you are the beneficial owner.

18. I held shares of BP ordinary shares in more than one account. Should I file a separate claim form for each account?

You should include all of your transactions in BP ordinary shares during the relevant period in one claim form, even if they were purchased or held using different brokerages or representatives. However, if you held BP ordinary shares in accounts that were different account types or held under different legal capacities (e.g., an individual account and a partnership account), you should complete a separate claim form for each.

19. If I was a co-owner of BP ordinary shares, do we both need to sign the claim form?

Yes, all owners must sign. However, if your co-owner is deceased, please read the next question below.

20. What should I do if the investor has died? How should the claim form be completed?

If the beneficial owner of the BP ordinary shares has died, and would have otherwise met the eligibility requirements of the BP Fair Fund, the estate or the legal heirs may be eligible for a distribution. The executor or administrator of the estate should sign and submit the claim form denoting his or her title (for example, “Executor of the Estate of John Doe”) on the signature page.

If no estate was opened, or if the estate is now closed, all the legal heirs of the investor should sign their names on the claim form, and add the word “Heir”. In either circumstance, you must attach copies (please do not send originals) of any legal documentation providing evidence you are the executor or Distribution Agent of the estate, or the legal heir of the deceased.

If you had a co-owner of the BP ordinary shares who has died, you should sign the claim form yourself, and send copies of documents that show:

|

a. |

The co-owner has died (for example, a copy of the death certificate); and |

|

b. |

You are legally entitled to the co-owner’s interest in the BP ordinary shares. |

After Your Claim Form Is Submitted

21. Will I be notified whether my claim was received by the Distribution Agent?

If you submit your claim using the on-line claim filing option, you will receive an electronic confirmation and corresponding claim ID immediately.

If you mail a claim form directly to the Distribution Agent, you will not receive confirmation of receipt from the Distribution Agent. We would encourage you to either use the online claim filing option, or to utilize a mailing option or courier service that will provide you with proof of delivery and receipt of the claim form by the Distribution Agent. The burden to prove receipt of the claim by the Distribution Agent will be upon the potential claimant.

22. Will I be notified whether my claim is accepted, rejected or deficient?

Yes. The Distribution Agent will provide a Claim Status Notice to each claimant that filed a deficient claim or if their claim is determined to be ineligible. For a deficient claim, the Claim Status Notice will provide an explanation of the deficiency and an instruction regarding what is required to cure the deficiency. For an ineligible claim, the Claim Status notice will provide the reason for such denial. All information submitted in response to a Claim Status Notice, either attempting to cure a deficient claim or requesting reconsideration of a rejected claim, must be postmarked no more than 30 days after the date of your Claim Status Notice.

After completion of the deficiency and reconsideration processes, the Distribution Agent will mail a Determination Notice to all claimants that filed a claim form. The Determination Notice will provide each claimant with the final ruling regarding the eligibility status of each claim.

23. How much will I be paid if I am eligible?

Until all claims have been fully processed, it is not possible to determine the amount of any individual payment because the amount will depend on a variety of factors; including, the number of eligible claims processed, the total dollar amount of the eligible claims, the amount of BP ordinary shares that you purchased, and the timing of your purchase and sale transactions.

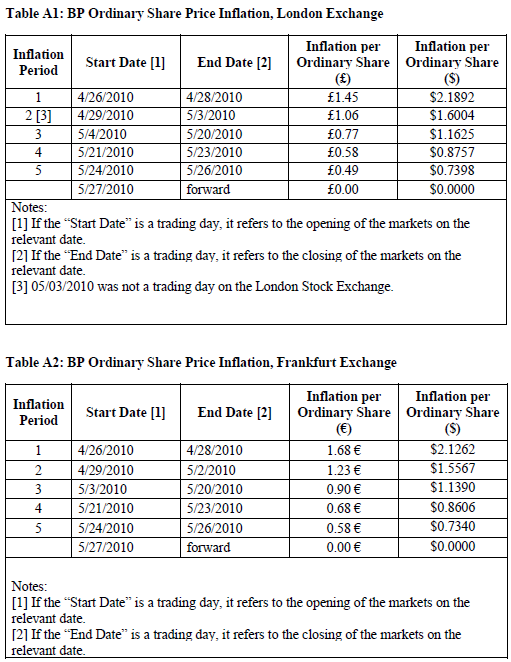

If you are determined to be eligible, the amount of your recovery will be based on the plan of allocation loss methodology that was approved by the Court and the Commission. The plan of allocation identifies the artificially inflated portion of the per-share price of BP ordinary shares that resulted from BP’s misstatements and omissions about the true rate at which oil was flowing into the Gulf of Mexico from the Deepwater Horizon oil rig. The artificial inflation amounts were approved by the Court. According to the plan of allocation, the inflation-per-share amounts are as follows:

Your eligible loss will be computed for all purchases and sales of BP ordinary shares during the relevant period, and then added together to arrive at your total eligible loss amount. Please note that your eligible losses will be used to determine the amount of your distribution payment from the Fair Fund; however, if the aggregate losses of all claimants exceeds the value of the Fair Fund, the Fair Fund will be distributed to eligible claimants proportionately based upon the ratio of the eligible losses of each claimant to the aggregate eligible losses of all eligible claimants.

You can read a more detailed explanation of the plan of allocation and how distribution payments are calculated, including examples showing the application of the methodology, in the Distribution Plan which is available on this website.

24. Will I have to pay taxes on my payment?

We cannot provide tax or other legal advice on this matter. It is your responsibility to determine and pay any federal, state or other taxes you may owe on recoveries you receive from the Fair Fund. Therefore, we recommend that you consult your tax advisor.

25. Can I get my payment in my local currency?

The Commission and the Distribution Agent are determining the feasibility of making payments to investors in their local currency. We will provide more information on this process as we near the distribution phase of the administration.

26. What should I do if I move after I submit my claim form?

If you move after you file your claim form, please be sure to provide your new address to ensure that we are able to contact you in the event you are eligible to receive a distribution payment. You can update your address by calling (866) 344-7868, sending an email to [email protected], or writing to:

BP Fair Fund

P.O. Box 6980

Syracuse, NY 13217-6980

Effect of Submitting a Claim

27. Am I giving up any legal rights by filing a claim form?

No. By submitting a claim form, you are not forfeiting any rights or claims you may have against BP, its past and present directors, officers, advisors or agents.

28. Is this case a class action?

No. This Fair Fund settlement is the result of an enforcement action brought by the U.S. Securities and Exchange Commission.

Institutional Filers

29. I am an institutional filer; may I file my claim electronically?

Yes. The Distribution Agent has established a procedure to enable institutional filers to submit claims electronically. The electronic filing template is available here.

30. Will the Distribution Agent ship blank claim forms to an institutional filer in bulk so that the institutional filer can mail them directly to clients?

No. The Distribution Agent will not mail bulk quantities of blank claim forms or other materials to an institutional filer. The claim form and all other relevant material can be downloaded directly from the Fair Fund website here, or you may direct your clients to submit their claim using the online claim filing option available here.

Getting More Information

31. I still have some questions. Who can I contact?

If you have additional questions, you may:

- Call toll-free (866) 344-7868 (Domestic) or (315) 671-5770 (International), Monday through Friday between 8:30am and 5:00pm, Eastern Standard Time;

- Send an email to us at [email protected]; or

- Write to:

BP Fair Fund

P.O. Box 6980

Syracuse, NY 13217-6980

BP ADS FAQ (Archived)

Holders of BP American Depository Shares are no longer eligible to recover from the BP Fair Fund. The FAQs for BP ADS have been archived and remain available for review using the provided link.

Ready to Begin the Claims Process? Start Today.

Have all the information you need? Ready to file your claim? Start today on paper or online.